In a sector such as airlines –where supply and demand shape an almost self-regulated and highly competitive model– reputation and consumer perception are critical. Under the current model, most travelers choose which airline to fly with based on personal criteria, forming a kind of short list of corporate personalities associated with specific values or experiences. This widespread system of direct purchase makes consumer perception a decisive factor in driving airline sales.

But how is this consumer perception evolving? And more importantly, what levers or drivers are key to transforming reputation?

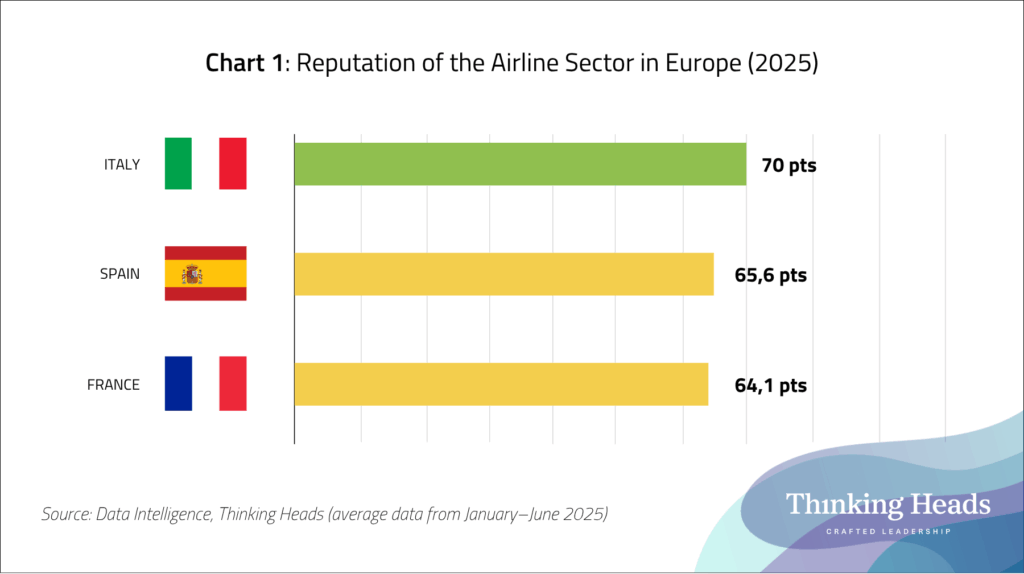

Currently, according to proprietary data from the Data Intelligence team at Thinking Heads, the airline sector enjoys a positive reputation in Europe, with an average score of 66.4 out of 100. Italians rate the sector the highest, being the only group to assign a score above 70. Spanish and French consumers, on the other hand, are the most critical, giving ratings of 65.5 and 64.1, respectively (Chart 1).

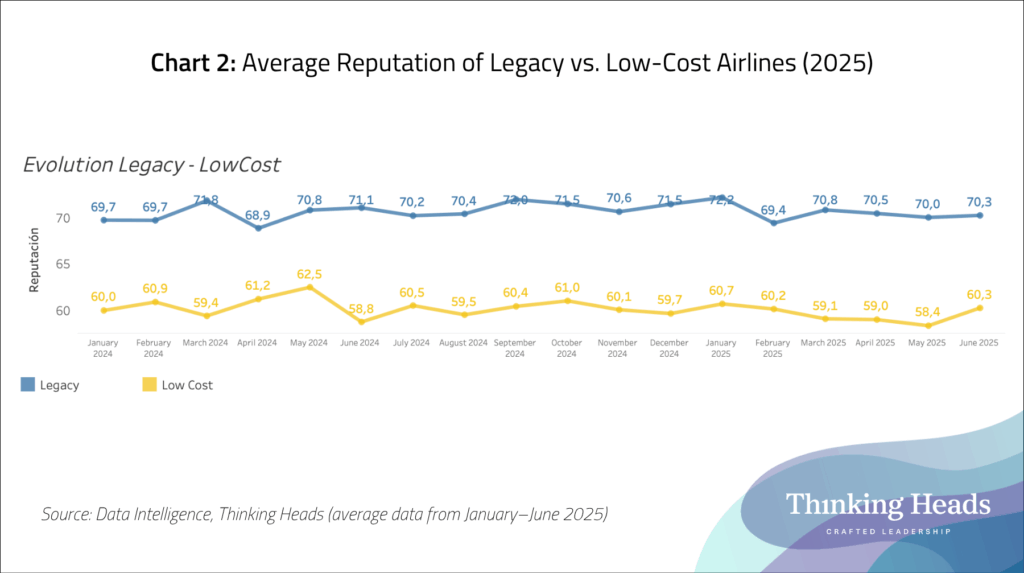

It is also important to distinguish between legacy airlines—traditional carriers—which maintain a stronger reputational position, and low-cost carriers (Chart 2).

This distinction is evident in the case of airlines such as Iberia, which holds the highest reputation score in Spain, as well as Lufthansa and Air France, with an average European reputation score of 74.5. In contrast, low-cost carriers such as Ryanair and Vueling (the highest-rated low-cost airline in the Spanish market) tend to score around 60 points, with demand highly influenced by pricing.

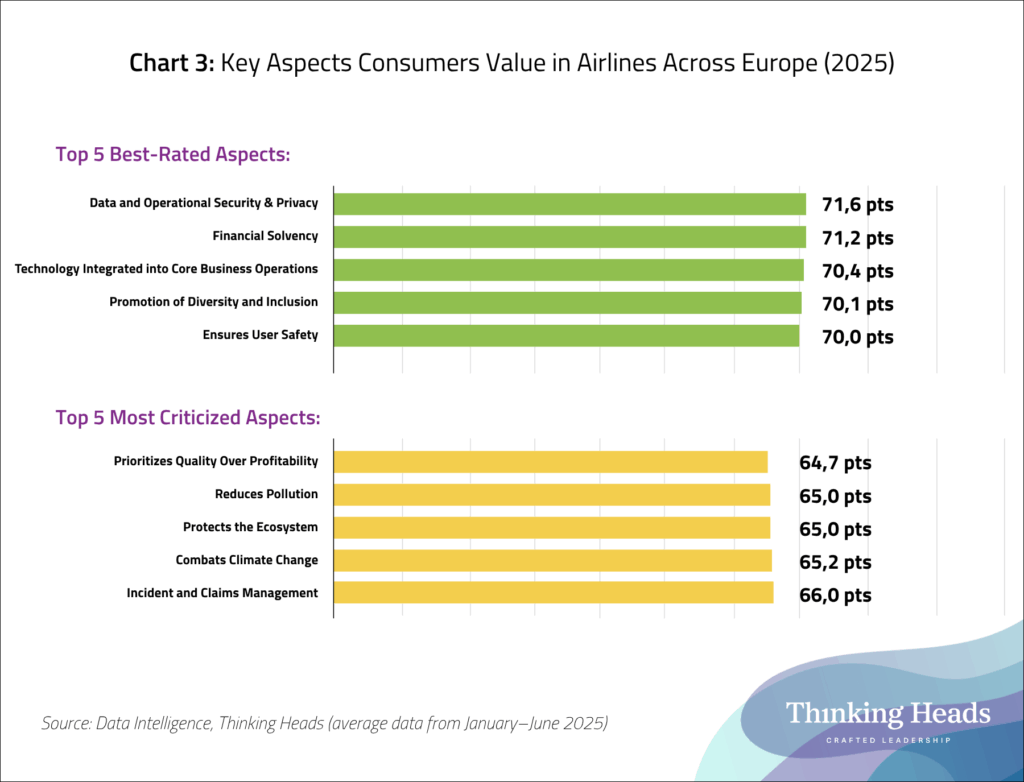

Nevertheless, understanding how consumers evaluate different aspects of the airline experience is essential in arriving at these final scores. These insights enable the identification of specific areas for improvement, and consequently, actionable levers to enhance reputation.

In this context –where implementing targeted initiatives to strengthen reputation is crucial– there are three strategic pillars to protect and build reputation, according to the report Approaching the Future 2025, developed by our partner Corporate Excellence:

The sector’s performance reveals that among the most positively rated aspects are technology, with a European average score of 70.4, and management, scoring 69.5. When it comes to building reputation, consumers place the highest importance on product and service offerings, followed by all aspects related to corporate ethics (Chart 3). However, environmental commitment remains the industry’s weakest area overall, with its lowest score at 65 out of 100.

In this landscape, having a solid reputation strategy—anchored in evidence-based insights and supported by a clear roadmap—is more critical than ever. At Thinking Heads, our Data Intelligence unit supports key sectors in achieving strategic positioning through data-driven reputation models, anticipating trends and building sustainable trust.

Consulting firm specializing in strategic positioning and influence management of organizations and leaders

Related Posts

Utilizamos cookies para mejorar tu experiencia en nuestro sitio web. Al usar nuestra web, aceptas el uso de cookies.

Los sitios web almacenan cookies para mejorar la funcionalidad y personalizar tu experiencia. Puedes configurar tus preferencias, pero bloquear algunas cookies puede afectar el rendimiento y los servicios del sitio.

Essential cookies enable basic functions and are necessary for the proper function of the website.

Google reCAPTCHA helps protect websites from spam and abuse by verifying user interactions through challenges.

Google Tag Manager simplifies the management of marketing tags on your website without code changes.

Service URL: thinkingheads.com (opens in a new window)

Statistics cookies collect information anonymously. This information helps us understand how visitors use our website.

Google Analytics is a powerful tool that tracks and analyzes website traffic for informed marketing decisions.

Service URL: policies.google.com (opens in a new window)

Puede encontrar más información en nuestra Cookies policy y en nuestra How we treat your data.